Definition and Examples of Locally Incurred Costs

Locally incurred costs include:

- Costs incurred and paid locally, and

- Costs incurred locally and paid in the U.S., if material (the audit firm is responsible for reasonably defining the materiality threshold), but

- Locally incurred costs do not include expatriates’ costs paid in the U.S.

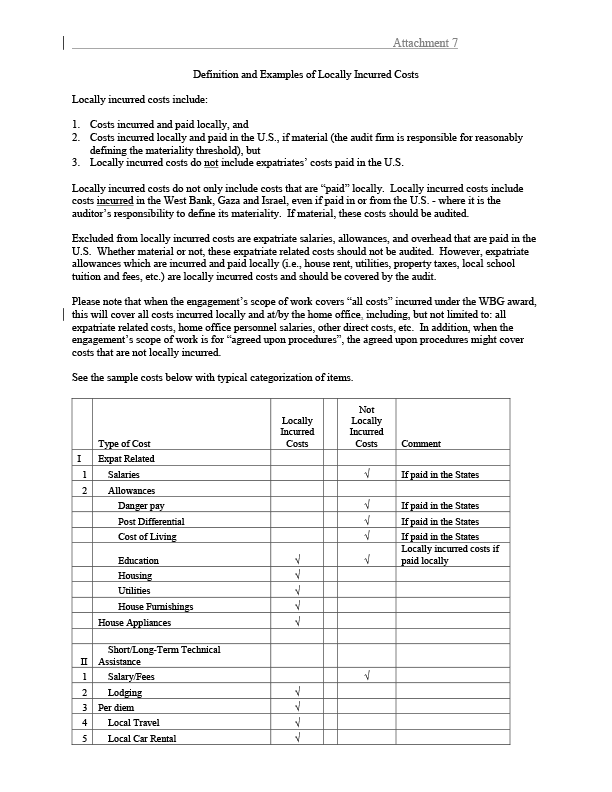

Locally incurred costs do not only include costs that are “paid” locally. Locally incurred costs include costs incurred in the West Bank, Gaza and Israel, even if paid in or from the U.S. - where it is the auditor’s responsibility to define its materiality. If material, these costs should be audited.

Excluded from locally incurred costs are expatriate salaries, allowances, and overhead that are paid in the U.S. Whether material or not, these expatriate related costs should not be audited. However, expatriate allowances which are incurred and paid locally (i.e., house rent, utilities, property taxes, local school tuition and fees, etc.) are locally incurred costs and should be covered by the audit.

Please note that when the engagement’s scope of work covers “all costs” incurred under the WBG award, this will cover all costs incurred locally and at/by the home office, including, but not limited to: all expatriate related costs, home office personnel salaries, other direct costs, etc. In addition, when the engagement’s scope of work is for “agreed upon procedures”, the agreed upon procedures might cover costs that are not locally incurred.

Comment

Make a general inquiry or suggest an improvement.