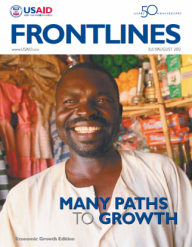

In Uganda, a USAID guarantee enabled an entrepreneur to receive a loan large enough to expand his business. As a result, his profits more than tripled, and he was able to hire 40 additional workers, including the chef in this photo.

Morgana Wingard

In Uganda, a USAID guarantee enabled an entrepreneur to receive a loan large enough to expand his business. As a result, his profits more than tripled, and he was able to hire 40 additional workers, including the chef in this photo.

Morgana Wingard

In Uganda, a USAID guarantee enabled an entrepreneur to receive a loan large enough to expand his business. As a result, his profits more than tripled, and he was able to hire 40 additional workers, including the chef in this photo.

Morgana Wingard

In Uganda, a USAID guarantee enabled an entrepreneur to receive a loan large enough to expand his business. As a result, his profits more than tripled, and he was able to hire 40 additional workers, including the chef in this photo.

Morgana Wingard

In Uganda, a USAID guarantee enabled an entrepreneur to receive a loan large enough to expand his business. As a result, his profits more than tripled, and he was able to hire 40 additional workers, including the chef in this photo. The borrower repaid his loan in full and has since received another loan, double in size, without a guarantee.

South Base Agro Ltd., a cotton ginnery located in Buslowe, Uganda, is critical to the country’s growing cotton market. Established in 1994 by CEO Kandap Kinariwalla, South Base provides thousands of small farmers with cotton seeds and plants. International cotton millers depend on South Base’s cotton exports.

How USAID's Development Credit Authority Works

But South Base’s bank had very conservative lending practices to agriculture enterprises it perceived as high risk. Therefore, despite its success, South Base was unable to qualify for the large amount of financing it needed to grow.

As part of its assistance strategy in the country, USAID wanted to find a way to channel excess capital back into the local economy, and in doing so took a non-traditional approach to development.

Instead of relying on training to sharpen the business skills of South Base and other similar businesses, USAID in 2002 decided to also work with local banks to encourage them to invest more of their capital in local businesses. Using the Development Credit Authority, a USAID credit guarantee program, the mission was able to mobilize local money—and not just that of U.S. taxpayers—to finance development.

By offering to share risk, USAID successfully encouraged local banks to increase their investments in small businesses like South Base. Under the risk-sharing agreements, seven banks lent $26 million of their own funds over five years to pre-identified sectors and, in the process, learned that lending to small businesses can be profitable.

Related Content

In addition to opening up local financing, USAID offered a complementary technical assistance program that taught Ugandan small business owners how to represent themselves to financial institutions and showed banks how to evaluate small business risk. By building capacity and equipping the banks with the guarantee facility, the system began to produce results.

Entrepreneurs no longer needed to depend on loan sharks for access to capital. Thanks to the credit guarantee and technical assistance, 273 small businesses and microfinance institutions received loans totaling $26.3 million. Given the central role these businesses played in their supply chains, the impact reverberated throughout the Ugandan economy.

South Base received $600,000 in local financing, and within four years, the company saw its annual sales top $500,000, and purchased cotton directly from 3,000 rural farmers and 24 middlemen. Uganda Microfinance Union used its loan to lend small amounts to more than 27,000 borrowers. A Ugandan fish exporter, Begumisa Enterprises Ltd., used its credit to purchase fish from 7,000 fishermen.

“Today we buy cotton directly and indirectly from 20 to 30,000 cotton farmers and our annual sales top $2 million. Financing has enabled us to grow …," said Kinariwalla.

In Uganda, as in most of the countries where it works, USAID uses credit guarantees to grow new markets. Through this guarantee, USAID demonstrated to banks that loans to small businesses are not as risky as perceived. After the guarantee expired, 70 percent of the borrowers received subsequent loans. Two international banks involved in the guarantee went on to open small business lending divisions.

“The Development Credit Authority guarantee facility is a partnership where the U.S. Government shares risk with a local bank. It is not U.S. Government money. It is local capital,” said Jackie Wakhweya, development finance specialist from the USAID mission in Uganda. “The DCA financing model fits into our Feed the Future strategy of investing in agriculture as a long-term driver of economic growth and food security.”

“All of this matters because, at the beginning of the value chain, there is a small farmer relying on the entire system to function,” said Ben Hubbard, director of the Development Credit Authority.

“Making agriculture value chains work by unlocking financing is the key to enabling people to grow their way out of poverty.”

Comment

Make a general inquiry or suggest an improvement.