Background

Small and medium enterprises (SMEs) continue to be the key to innovation and the engine of sustainable economic growth and job creation in Jordan. SMEs represent roughly 95% of all registered companies in Jordan, contribute 50 percent or more to GDP and provide employment to an estimated 60 percent of the Jordanian workforce. Despite the crucial role they play in Jordan’s economic growth, SMEs-- and particularly women owned SMEs-- have great difficulty accessing the financing needed for start-up and growth. Bank financing for SMEs is limited by a weak financial infrastructure including lack of credit information, weak creditor rights, and a deficient secured transactions (collateral) infrastructure.

Project overview

USAID, in partnership with the Overseas Private Investment Corporation (OPIC), established the Jordan Loan Guarantee Facility (JLGF), an inclusive finance activity that is improving access to finance for SMEs in Jordan. JLGF provides partial loan guarantees and technical assistance to mobilize bank financing for creditworthy but previously underserved SMEs.

Consistent with USAID objectives, JLGF is promoting long-term sustainable development through high-impact partnerships with private and financial sectors in Jordan to facilitate the introduction and application of best practices in SME financial management and SME credit. JLGF is stimulating private-sector-to-private-sector investment – the most effective path to sustainable economic growth, job creation, and community development.

Activities

Mobilizing bank lending for SMEs using loan guarantees

- JLGF provides partial loan guarantees to support creditworthy SMEs that: (1) have a well-defined market opportunity to start-up or expand; (2) need financing to achieve their goal; but (3) lack the collateral banks normally require for making loans. JLGF guarantee covers 60 percent of loan principal for businesses located in Amman, 75 percent of loan principal for businesses located in governorates outside Amman, and for women-owned businesses regardless of location.

- Eligible loan purposes include financing equipment, construction, inventory, and accounts receivables. Loans typically range in size from 17,700 JD to 530,000 JD with terms of up to seven years. Larger loans can be considered on an exceptional basis if the business has significant job creation potential and/or it is of strategic or competitive significance to Jordan's private sector development. JLGF currently works with seven partner banks: Arab Bank, Cairo Amman Bank, Capital Bank, Bank Al Etihad, Housing Bank, Jordan Ahli Bank, and Jordan Kuwait Bank.

Building the capacity of banks and SMEs to increase sustainable SME access to finance

- JLGF conducts workshops for bank loan officers to build their capacity in applying SME credit underwriting and loan monitoring practices consistent with international best practices. These approaches will enable banks to reduce their over reliance on collateral – one of the main barriers to SME access to finance.

- JLGF is providing technical assistance to its partner banks to help them institutionalize international best practices in SME credit.

- JLGF is assisting the Institute of Banking Studies (IBS) to develop and deliver an SME Credit Diploma Program. JLGF is also helping IBS prepare to apply for international accreditation.

- Using the latest tools for entrepreneurs including the Business Model Canvas and collaborative cloud-based financial analysis, JLGF is conducting workshops to assist SMEs that are starting-up or expanding.

IMPACT

JLGF has coupled highly innovative and practical technical assistance and capacity building with the issuance of over 214 loan guarantees to enable Jordanian SMEs to access over $50 million in bank financing for start-up and expansion. More than 5,900 jobs have been supported with an additional 1,500 jobs expected to be created as these businesses start-up and grow.

Developing the economy outside of Amman

Over 30 percent of JLGF beneficiaries are outside of Amman -- in Aqaba, Balqa, Madaba, Jerash, Irbid, Karak, Ma’an, and Zarqa. These business operate in a variety of sectors including food processing, food services, pharmaceuticals, light manufacturing, tourism, retail, and wholesale trade.

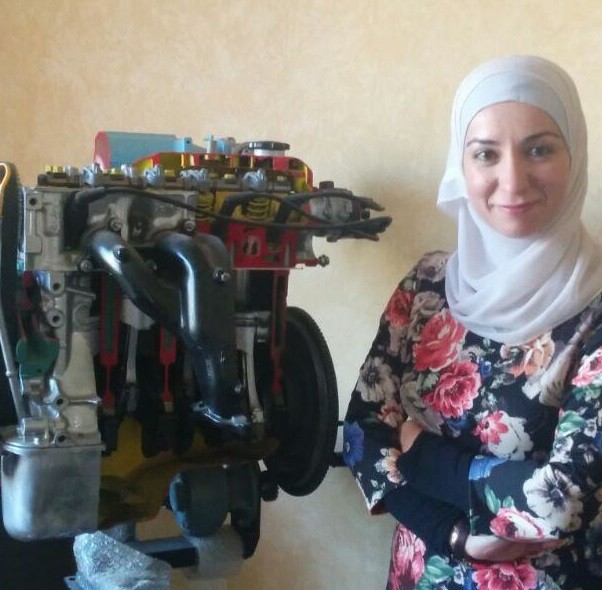

Supporting women SME entrepreneurs

Over 12 percent of loan guarantees have benefitted women-owned business. In addition, JLGF provided financial management training to build the capacity of over 150 women through special workshops for women entrepreneurs.

Enabling private-sector led sustainable community development

By mobilizing private-sector financing for private-sector solutions to Jordan’s development challenges, JLGF is enabling sustainable community development that grant providing programs cannot replicate.

Helping to start the clean technology revolution in Jordan

JLGF has facilitated the financing needed for the installation of solar energy systems at schools, universities, and factories. By enabling these transactions, JLGF is creating paths that will build the confidence for others to follow.

Institutionalizing changes that will provide sustainable access to finance for SMEs

JLGF has trained over 230 bank staff members in best practices in SME credit analysis and has conducted workshops for over 720 SME business owners and managers to build their capacity in financial management.

Comment

Make a general inquiry or suggest an improvement.