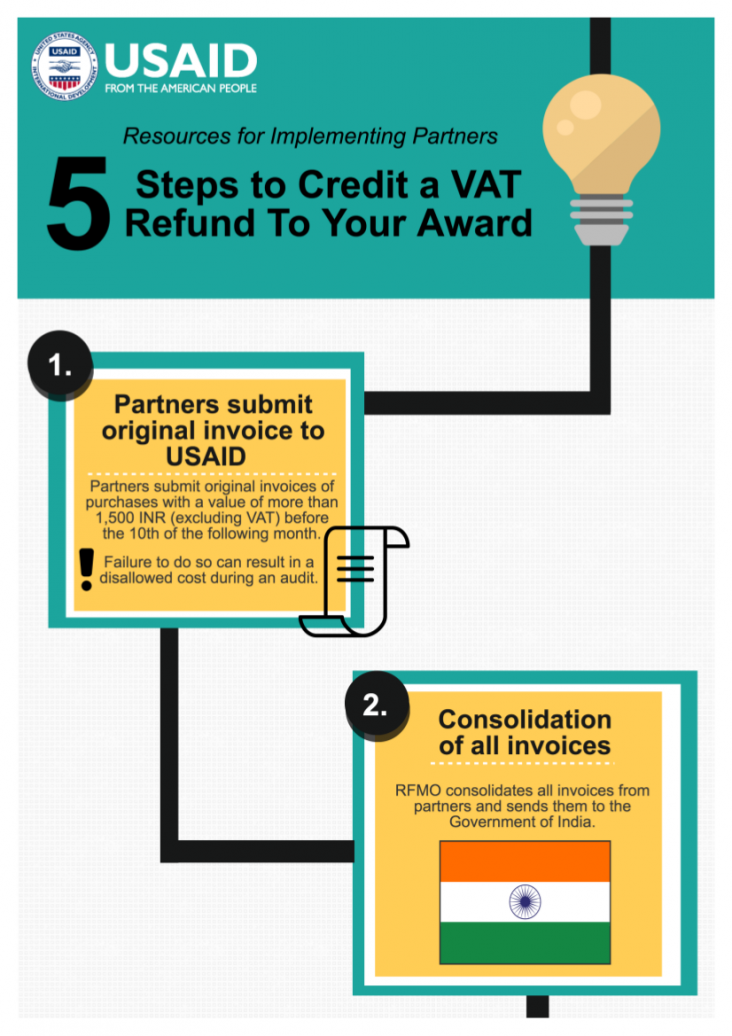

Resources for Implementing Partners

5 Steps to Credit a VAT Refund to Your Award

1. Partners submit original invoice to USAID

Partners submit original invoices of purchases with a value of more than 1,500 INR (excluding VAT) before the 10th of the following month. Failure to do so can result in a disallowed cost during an audit.

2. Consolidation of all invoices.

RFMO consolidates all invoices from partners and sends then to the Government of India.

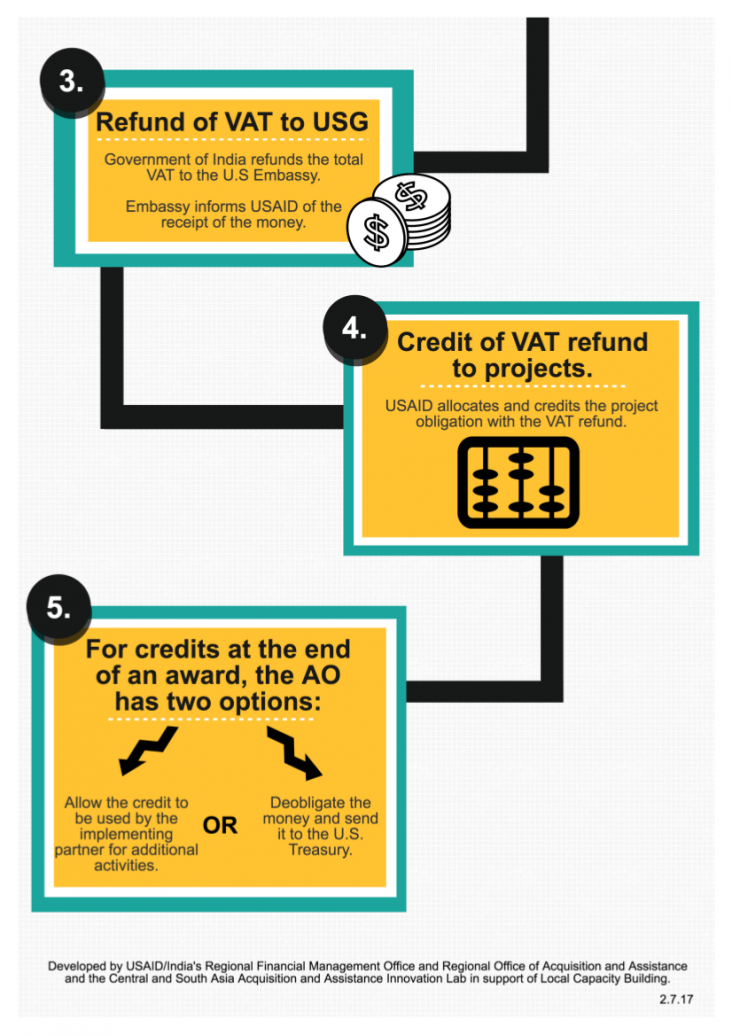

3. Refund of VAT to USG.

Government of India refunds the total VAT to the U.S. Embassy. Embassy informs USAID of the receipt of the money.

4. Credit of VAT refund to projects.

USAID allocates and credits the project obligation with the VAT refund.

5. For credits at the end of an award, the AO has two options:

Allow the credit to be used by the implementing partner for additional activities. OR Deobligate the money and send to the U.S. Treasury.

Developed by USAID/India’s Regional Financial Management Office and Regional Office of Acquisition and Assistance and the Central and South Asia Acquisition and Assistance Innovation Lab in support of Local Capacity Building

Comment

Make a general inquiry or suggest an improvement.